Top Embedded Finance Trends Shaping the Future in 2026

The top embedded finance trends in 2026 include integration into everyday objects, AI-powered payment routing, real-time payments, alternative payment methods, and expansion into lending and insurance. These trends drive rapid growth in financial technology and fintech, making financial services more accessible and efficient.

| Statistic | Value |

|---|---|

| Businesses planning to launch embedded finance solutions | 64% |

| Projected market size by 2027 | USD 7.2 trillion |

| Expected CAGR | 22% |

Companies add financial tools to platforms, which enhances convenience and increases revenue. Real-time payments and embedded finance solutions influence consumer behavior and business strategy. Fintech trends in 2026 shape how industries operate and create new opportunities for both businesses and consumers.

Key Takeaways

Embedded finance integrates financial services into everyday objects, making transactions seamless and convenient for consumers.

AI-powered payment routing enhances transaction efficiency, leading to faster approvals and reduced payment failures for businesses.

Real-time payments are transforming cash flow management, allowing businesses and consumers to expect instant transactions and refunds.

Embedded Finance in Everyday Life

Smart Devices with Built-In Bank Accounts

Smart devices now do more than connect to the internet. Many new cars and home appliances come with built-in bank accounts. This trend allows people to pay for services, manage subscriptions, or even receive payments directly from their devices. For example, a car can pay for tolls, parking, or charging without the driver needing to use cash or cards. A refrigerator can reorder groceries and pay for them automatically. These features use digital wallets to make payments seamless and secure.

The adoption of embedded finance in everyday objects brings many benefits. People save time because they do not need to visit banks for basic services. Businesses reduce payment errors and fraud risks. The table below shows how embedded finance improves convenience, revenue, cost savings, personalization, access, and security for both consumers and businesses:

| Benefit | Impact on Consumers | Impact on Businesses |

|---|---|---|

| Convenience | Saves customers from visiting banks for services | Reduces need for longer payment terms |

| Revenue | Increases customer loyalty and average order volume | Attracts new customers and diversifies revenue streams |

| Cost savings | Reduces shipping fees and offers better rates | Saves money and time by avoiding compliance costs |

| Personalization | Enables tailored financial products | Uses data to meet customer needs |

| Access | Increases financial service accessibility | Expands credit access in under-banked areas |

| Security | Protects sensitive payment information | Reduces payment errors and fraud risks |

Sector Expansion: E-commerce, Ride-Hailing, Agriculture

Many industries now use embedded finance to improve their services. E-commerce platforms, such as Shopify, offer embedded payments and lending. This approach increases merchant retention and opens new revenue streams. Ride-hailing apps provide digital wallets, making payments easier for both drivers and riders. These wallets also enhance the customer experience.

affiliate link

In agriculture, embedded finance helps small farmers get credit and manage money. The use of technology in lending improves risk management and lowers transaction costs. As a result, productivity in the agricultural sector increases. The list below highlights the main outcomes in agriculture:

Improved access to credit for small and marginal farmers.

Enhanced financial inclusion.

Better risk management through technology.

Lower transaction costs.

Increased productivity.

These trends show that embedded finance is changing how people and businesses interact with money every day.

AI in Fintech and Embedded Finance

AI-Powered Payment Routing

AI-powered payment routing is transforming fintech by making transactions faster and more reliable. Intelligent systems now match each transaction to the best-performing bank or network. This process increases approval rates and reduces failed payments. Many platforms connect directly to card networks, which gives them more control and speeds up decisions. Local scheme routing helps businesses succeed in different markets by using local payment rails. Dynamic bank routing chooses the most effective path for each payment based on card type, region, and performance data. Smarter retries recover declined payments without disrupting the customer experience.

| Feature | Benefit |

|---|---|

| Intelligent routing | Matches transactions to the best-performing bank or network |

| Direct scheme connections | Provides faster decisions and more control |

| Local scheme routing | Increases acceptance in local markets |

| Dynamic bank routing | Ensures the most effective path for each transaction |

| Smarter retries | Recovers declined payments and potential revenue |

Efficiency and Optimization in Transactions

Fintech trends in 2026 show that artificial intelligence is the backbone of many financial services. Agentic AI systems act on their own to improve efficiency and spark innovation. Over 60% of finance teams worldwide plan to fully deploy AI by 2026. Organizations using AI-powered payment analytics see about a 40% decrease in uncontrollable payment costs. They also prevent nearly 90% of overcharges from affecting their finances. Procurement teams report that predictive analytics improve their response times to payment disruptions by up to 40%. Seventy percent of financial institutions report at least a 5% revenue increase from AI initiatives. More than 60% also see cost savings of 5% or more. The global AI in finance market is expected to grow rapidly, reaching over $190 billion by 2030. AI now suggests, purchases, and integrates insurance plans based on real-time data from various accounts.

AI-driven optimization in fintech creates faster, smarter, and more cost-effective financial operations for businesses and consumers.

Embedded Payments and Seamless Experiences

Business Payment Trends in 2026

Business payment trends in 2026 show a shift toward faster, more personalized, and more secure transactions. Companies use embedded payments to streamline modern payment workflows and improve financial operations. The table below highlights the main trends shaping the future of payments:

| Trend | Description |

|---|---|

| Stablecoins | Regulatory framework established by the Genius Act will enhance the use of stablecoins for cross-border transactions. |

| Personalization of payments | AI will enable personalized payment suggestions, improving user experience and influencing payment choices. |

| Interchange fees | Ongoing regulatory scrutiny may lead to changes in interchange fee structures, impacting payment processing costs. |

| Embedded payment solutions | Integration of payment options into various platforms enhances user experience and personalizes payment methods. |

Digital wallets play a key role in these trends. They allow users to pay, receive, and manage money within a single platform. Fintech companies continue to innovate, making financial services more accessible and efficient.

Enhancing User Experience Across Industries

Seamless embedded payments transform how people interact with businesses. Companies like eBay and GoFundMe increase customer loyalty by letting users complete transactions without leaving their platforms. This integration reduces friction and leads to higher satisfaction and retention rates.

Embedded payments boost conversion rates and lower the number of abandoned transactions.

The speed and simplicity of these solutions improve the overall user experience.

Customers enjoy more control over their financial choices, which builds trust and loyalty.

In 2026, industries that adopt embedded payments will see stronger relationships with their customers. These solutions help businesses stay ahead in a fast-changing financial landscape.

Real-Time Payment Infrastructure

affiliate link

Instant Transactions and Settlements

In 2026, real-time payments will set new standards for speed and efficiency in the financial world. Businesses and consumers both benefit from instant transactions and settlements. Companies gain immediate access to funds, which helps them manage cash flow and respond quickly to changing needs. Customers now expect instant confirmations and refunds, which changes how they view payment experiences.

The table below shows how instant transactions impact different areas:

| Impact Area | Description |

|---|---|

| Business Cash Flow | Instant access to funds enhances flexibility and responsiveness, allowing for better cash flow management. |

| Consumer Expectations | Customers now expect immediate transaction confirmations and refunds, reshaping their payment experience. |

| Inventory Management | Merchants can place rush orders confidently, knowing funds are available immediately. |

| Supplier Relationships | Instant payments can lead to better negotiation terms with vendors, enhancing business operations. |

| Refund Processing | Instant refunds build trust and satisfaction, improving customer loyalty and reducing support inquiries. |

| Overall Payment Experience | Customers expect real-time updates and confirmations, necessitating a rethink of user experience design. |

These changes push businesses to rethink their payment infrastructure and focus on delivering a seamless experience.

Global Reach and Financial Inclusion

Real-time payment infrastructure in 2026 will help close the gap for people who lack access to traditional financial services. Countries like Brazil and India lead the way with systems such as Pix and Unified Payments Interface (UPI). These platforms now handle almost two-thirds of global instant payment transactions. Millions of individuals and small businesses use these systems to access secure, instant, and affordable financial services.

Brazil’s Pix and India’s UPI show how digital public infrastructure can drive financial inclusion.

Real-time payments give more people the chance to participate in the financial system.

Small enterprises benefit from faster, safer transactions, which support business growth.

As real-time payments expand worldwide, more people and businesses will enjoy the benefits of a modern financial system in 2026.

Alternative Payment Methods

Rise Beyond Traditional Card Payments

The world of payments is changing quickly. Many people now look for options beyond traditional card payments. Pay by Bank is one method that is gaining traction. This option stands out for its efficiency, cost savings, and speed. Regulatory support in many regions helps drive its adoption. In Europe, Pay by Bank allows real-time settlement directly into merchant accounts. This feature improves operational efficiency and creates a better customer experience.

Digital wallets like Apple Pay and Google Pay are also becoming more popular. These wallets offer speed, security, and less friction during checkout. By 2026, experts expect digital wallets to dominate e-commerce payments. The fintech industry continues to innovate, making these alternative payment methods more accessible for everyone.

Pay by Bank offers real-time settlement and lower costs.

Digital wallets provide secure and fast transactions.

Merchants benefit from improved efficiency and happier customers.

Shifting Consumer Preferences

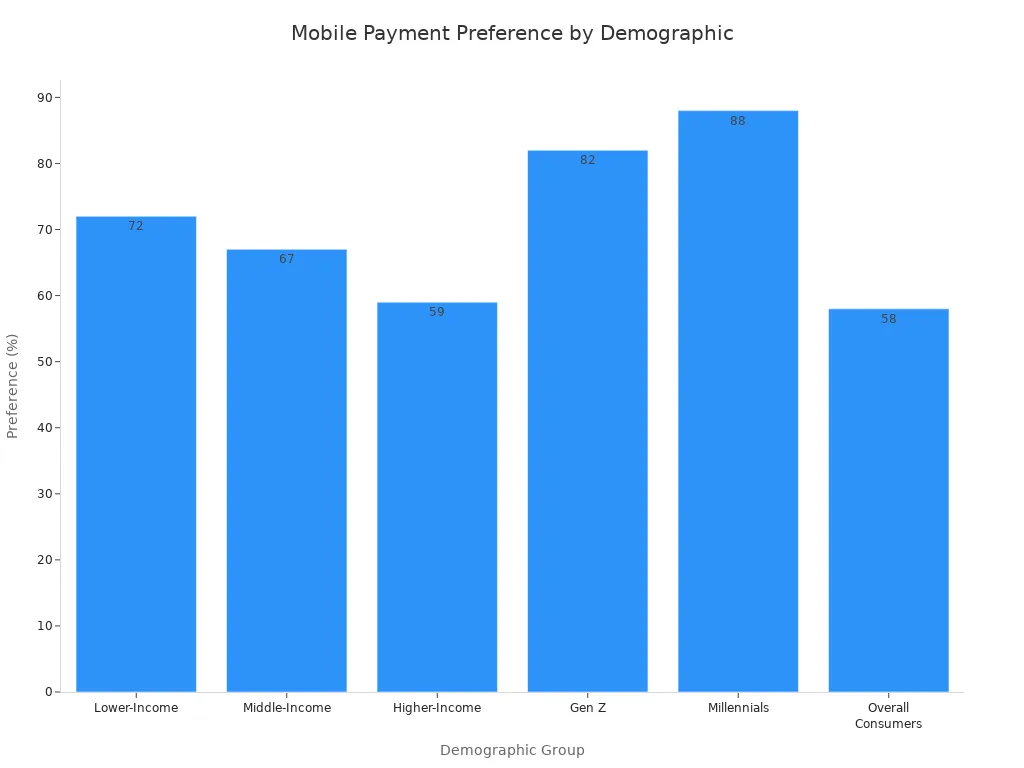

Consumer preferences play a big role in the growth of alternative payment methods. Many people want to pay when and where they choose. In fact, 28% of consumers say this flexibility is their main reason for using digital payments. Mobile payments and smartwatches are now common for everyday purchases. About 58% of consumers across all income levels use these tools.

The table below shows how different groups prefer mobile payments:

| Demographic | Mobile Payment Preference |

|---|---|

| Lower-Income | 72% |

| Middle-Income | 67% |

| Higher-Income | 59% |

| Gen Z | 82% |

| Millennials | 88% |

| Overall Consumers | 58% |

These trends show that people want more control over their financial choices. Businesses that offer flexible payment options can reach more customers and stay ahead in the changing financial landscape.

Embedded Lending and Insurance

affiliate link

Diversification of Embedded Finance Services

In 2026, embedded finance continues to expand beyond payments. Many fintech companies now offer new lending and insurance products directly within digital platforms. These services help users access credit and protection without leaving their favorite apps. For example, “Buy Now, Pay Later” lets shoppers split payments into smaller amounts at checkout. This option appears on many e-commerce sites and increases purchasing power for the average consumer.

The table below highlights some of the latest products and models:

| Product Type | Description | Companies Offering |

|---|---|---|

| Buy Now, Pay Later | Allows consumers to split payments into smaller amounts during purchases. | Klarna, Affirm, Afterpay |

| Insurance Model | Benefits | Target Audience |

|---|---|---|

| Embedded Insurance | Closes protection gaps and boosts loyalty. | Banks and Fintechs |

| Transactional Insurance | Offers personalization and stronger margins. | Scaling Fintechs |

This diversification gives users more choices and helps businesses stand out in a crowded market.

Opportunities for Businesses and Consumers

The market for embedded lending and insurance is growing quickly. In 2023, the market size reached about USD 12 billion. Experts predict a compound annual growth rate of 24.5%, which could push the market to USD 45 billion by 2028. The main drivers include rapid digital transformation, demand for seamless financial services, and the rise of API-driven ecosystems.

Rapid digital transformation across sectors

Increasing demand for seamless financial services

Proliferation of API-driven ecosystems

The financial services landscape is undergoing a fundamental transformation, driven by telecom networks leveraging their infrastructure to embed financial services directly into digital platforms.

In 2026, businesses can use these trends to attract new customers and increase revenue. Consumers benefit from easier access to credit and insurance, making financial decisions simpler and more secure.

Cybersecurity and Compliance in Embedded Finance

New Security Challenges

Cybersecurity stands as a top priority for embedded finance platforms in 2026. The rapid growth of fintech brings new risks that demand strong defenses. Large-scale breaches, such as the 2025 Oracle E-Business Suite zero-day attack, show the importance of managing third-party and supply-chain risks. Providers must assess vendors regularly and build robust risk management strategies.

| Challenge | Description |

|---|---|

| Third-Party & Supply-Chain Risk | Large-scale breaches highlight the need for robust third-party risk management and continuous vendor assessments. |

| Regulatory Compliance | Evolving regulations require enterprises to demonstrate continuous compliance and maintain cyber insurance. |

Cyberwar is now a reality. Nation-states like China and Russia use coordinated strategies to reach their goals. The stakes in cybersecurity have never been higher. These threats push financial service providers to invest in advanced security tools and incident-response plans.

Regulatory Trends for 2026

Regulatory trends in 2026 focus on transparency and responsible product design. Regulators want fintech companies to offer products that suit consumers’ needs. They also push for simpler rules. The Digital Omnibus and AMLA initiatives aim to streamline compliance for financial platforms.

Transparency in embedded finance products is a growing requirement.

Regulators focus on the suitability of financial products for consumers.

Responsible product design is now a key expectation.

The EU and UK discuss a single rulebook to simplify compliance.

New anti-money laundering and counter-terrorism measures are being implemented.

Providers adapt by automating compliance processes and building dedicated teams. Many use AI-driven tools to monitor transactions and reduce false positives. Modular compliance frameworks help companies grow internationally while meeting local rules. Ongoing training ensures employees stay updated on compliance obligations.

In 2026, strong cybersecurity and compliance practices will help fintech companies protect users and build trust in the financial ecosystem.

Personalization in Embedded Finance

Data-Driven Customer Experiences

In 2026, personalization stands at the center of embedded finance. Companies use advanced data analytics to understand what customers want and need. AI co-pilots now anticipate customer needs and automate many financial decisions. These systems help people make better choices by offering predictive insights. Many platforms provide financial-wellbeing coaching, which sets them apart from others.

AI co-pilots anticipate needs and automate decisions.

Predictive insights help customers act before problems arise.

Financial-wellbeing coaching builds trust and confidence.

Marketing teams also benefit from automation. Systems now handle planning and optimization tasks, freeing people to focus on creative work. Real-time data keeps opportunities fresh and relevant. This approach helps both businesses and customers reach their goals faster.

Building Loyalty Through Personalization

Personalization in embedded finance creates stronger connections between users and platforms. By integrating financial services into daily routines, companies increase user engagement. This approach leads to higher revenue per user and greater lifetime value. As platforms become trusted financial partners, they keep their core identity while improving the user experience. This strategy is key for building long-term loyalty in the fintech world.

Personalized financial services in 2026 help users feel understood and valued. Companies that invest in these experiences see lasting relationships and steady growth.

The table below highlights the top embedded finance trends for 2026, including advanced Banking-as-a-Service, personalized finance, and decentralized stablecoins. Businesses and the consumer should focus on technology, compliance, and customer needs.

Ongoing learning through newsletters and events helps everyone stay ahead in the evolving fintech landscape.

| Trend | Description |

|---|---|

| Advanced BaaS | Complex integrations for non-financial firms |

| Personalized Embedded Finance | AI-driven, user-focused experiences |

| Decentralized Stablecoins | Faster, cost-effective cross-border transactions |

FAQ

What is embedded finance?

Embedded finance means integrating financial services like payments, lending, or insurance into non-financial platforms. Users access these services directly within apps or devices.

How does AI improve payment routing?

AI analyzes transaction data and selects the fastest, most reliable payment path. This process increases approval rates and reduces failed payments for businesses and consumers.

Which industries benefit most from embedded finance?

E-commerce, ride-hailing, agriculture, and smart device manufacturers see major benefits. These sectors gain efficiency, better customer experiences, and new revenue streams.