Top Technical Indicators for Profitable Commodity Trades

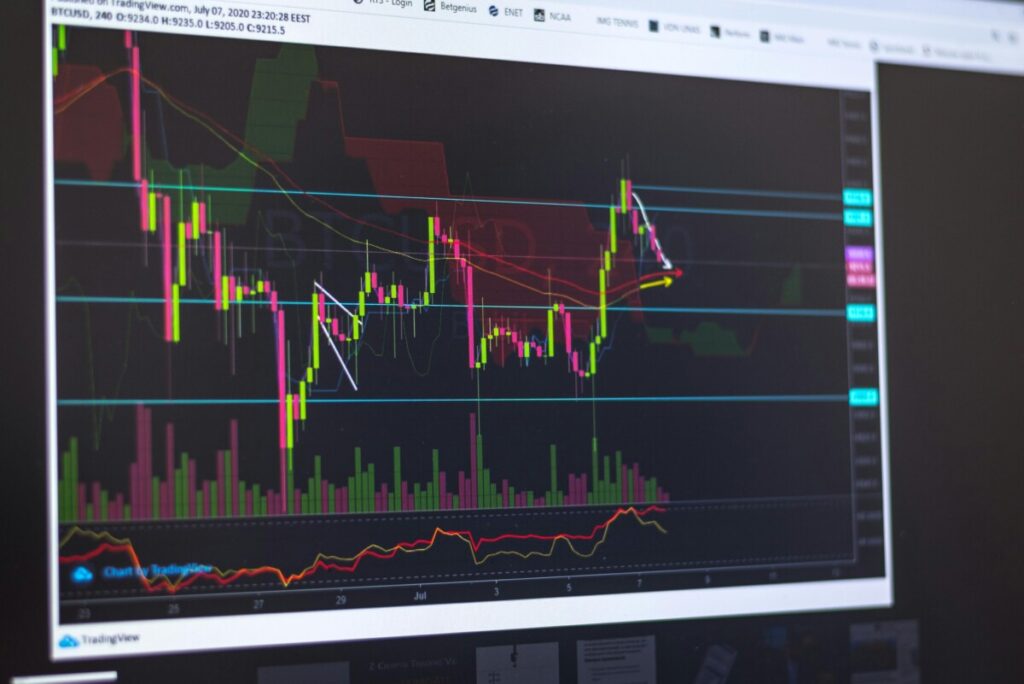

In the world of commodity trading, technical indicators play a crucial role in helping you make informed decisions. These tools provide insights into market trends and potential reversals, enhancing your trading strategies. For instance, moving averages help you identify trend directions and determine support and resistance levels. By understanding technical analysis for commodities, you can better predict market movements. Indicators like the Relative Strength Index (RSI) and Bollinger Bands offer valuable signals about overbought or oversold conditions, guiding you toward profitable trades. Embracing these indicators can significantly boost your trading success.

Technical Analysis for Commodities

https://67759jsyw78wjkbd4b8dy1dl9u.hop.clickbank.net

What are Technical Indicators?

Definition and Purpose

Technical indicators are mathematical calculations based on price and volume data. They help you understand market dynamics and identify potential trading opportunities. By analyzing these indicators, you can spot trends, reversals, and entry and exit points. This knowledge is crucial for making informed decisions in commodity trading.

Types of Technical Indicators

There are various types of technical indicators, each serving a unique purpose:

Trend-following indicators: These help you identify the direction of the market. Moving averages are a common example.

Oscillators: Useful in range-bound markets, they indicate overbought or oversold conditions. The Relative Strength Index (RSI) is a popular oscillator.

Volatility indicators: These measure market volatility. Bollinger Bands are widely used for this purpose.

How Technical Indicators Work

Components of Technical Indicators

Technical indicators consist of several components that provide insights into market behavior:

Price data: This includes open, high, low, and close prices.

Volume data: The number of contracts or shares traded.

Timeframes: Different periods, such as daily or weekly, affect the indicator’s sensitivity.

Understanding these components helps you interpret the signals accurately.

Interpreting Indicator Signals

Interpreting signals from technical indicators is essential for successful trading. Each indicator provides specific signals:

Trend indicators: They show whether the market is moving up, down, or sideways.

Oscillators: These indicate when a market is overbought or oversold, suggesting potential reversals.

Volatility indicators: They highlight periods of high or low volatility, helping you adjust your strategies accordingly.

By mastering these signals, you can enhance your trading strategies and make more profitable decisions.

Key Technical Indicators for Commodity Trading

Moving Averages

Moving averages are essential tools in technical analysis for commodities. They help you identify trends and potential reversal points.

Simple Moving Average (SMA)

The Simple Moving Average (SMA) calculates the average price over a specific period. It gives equal weight to all prices within that timeframe. You can use SMA to smooth out price data, making it easier to spot trends. For instance, a rising SMA indicates an upward trend, while a falling SMA suggests a downward trend.

Exponential Moving Average (EMA)

The Exponential Moving Average (EMA) differs from SMA by giving more weight to recent prices. This makes EMA more responsive to new information. Traders often prefer EMA for its ability to capture short-term trends. By comparing EMA with SMA, you can gain insights into market momentum and potential entry or exit points.

Relative Strength Index (RSI)

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. It’s a vital part of technical analysis for commodities.

Understanding RSI

RSI ranges from 0 to 100 and helps you identify overbought or oversold conditions. An RSI above 70 indicates that a commodity might be overbought, while an RSI below 30 suggests it could be oversold. This information can guide you in making informed trading decisions.

RSI Signals and Interpretation

Interpreting RSI signals involves looking for divergence, failure swings, and centerline crossovers. Divergence occurs when the price moves in the opposite direction of the RSI, indicating a potential reversal. By understanding these signals, you can enhance your trading strategies and improve profitability.

Bollinger Bands

Bollinger Bands are another crucial component of technical analysis for commodities. They measure market volatility and provide insights into potential price reversals.

Components of Bollinger Bands

Bollinger Bands consist of three lines: the middle band (a moving average), and two outer bands that represent standard deviations from the middle band. These bands expand and contract based on market volatility.

Using Bollinger Bands in Trading

You can use Bollinger Bands to identify overbought or oversold conditions. When prices touch the upper band, the market might be overbought. Conversely, touching the lower band suggests it could be oversold. By incorporating Bollinger Bands into your analysis, you can make more informed trading decisions.

MACD (Moving Average Convergence Divergence)

The MACD is a powerful tool in technical analysis, especially for commodity trading. It helps you identify trends and potential trade opportunities by analyzing the relationship between two moving averages.

MACD Components

The MACD consists of three main components:

MACD Line: This line is the difference between the 12-day and 26-day Exponential Moving Averages (EMA). It shows the momentum of the market.

Signal Line: A 9-day EMA of the MACD line. It acts as a trigger for buy and sell signals.

Histogram: The difference between the MACD line and the signal line. It visually represents the strength of the trend.

Understanding these components allows you to gauge market momentum and potential shifts.

MACD Signals

Interpreting MACD signals can enhance your trading strategy:

Crossovers: When the MACD line crosses above the signal line, it suggests a potential buy signal. Conversely, when it crosses below, it indicates a potential sell signal.

Divergence: If the price moves in the opposite direction of the MACD, it may signal a potential reversal. This divergence can alert you to changes in trend strength.

Histogram Analysis: A growing histogram indicates increasing momentum, while a shrinking one suggests weakening momentum.

By mastering these signals, you can make more informed decisions and improve your trading outcomes.

Applying Technical Indicators in Trading

https://2fb44il2m9bsjkah58taudncer.hop.clickbank.net

Combining Indicators for Better Signals

Using multiple technical indicators can enhance your trading strategy. Each indicator provides unique insights, and combining them can lead to more accurate signals.

Benefits of Using Multiple Indicators

Enhanced Accuracy: By using several indicators, you can confirm signals and reduce false positives. For example, combining the MACD with moving averages can provide a clearer picture of market trends.

Comprehensive Analysis: Different indicators analyze various aspects of the market. While one might focus on momentum, another could highlight volatility. This comprehensive view helps you make informed decisions.

Risk Management: Multiple indicators can help you identify potential risks. By understanding different market conditions, you can adjust your strategies accordingly.

Examples of Indicator Combinations

MACD and RSI: The MACD helps identify trend direction, while the RSI indicates overbought or oversold conditions. Together, they can signal potential entry or exit points.

Bollinger Bands and Moving Averages: Bollinger Bands measure volatility, and moving averages show trend direction. This combination can help you spot potential reversals.

Stochastic Oscillator and Support/Resistance Levels: The Stochastic Oscillator identifies momentum, and support/resistance levels indicate potential reversal points. Using them together can enhance your trading strategy.

Backtesting and Strategy Development

Backtesting is a crucial step in developing a successful trading strategy. It involves testing your strategy on historical data to evaluate its effectiveness.

Importance of Backtesting

Performance Evaluation: Backtesting allows you to see how your strategy would have performed in the past. This helps you understand its strengths and weaknesses.

Strategy Refinement: By analyzing past performance, you can refine your strategy. Adjusting parameters and indicators based on backtesting results can improve future outcomes.

Confidence Building: Knowing that your strategy has worked in the past can boost your confidence. This assurance can help you stick to your plan during volatile market conditions.

Developing a Trading Strategy

Define Your Goals: Clearly outline what you want to achieve with your trading strategy. Whether it’s maximizing profits or minimizing risks, having clear goals will guide your decisions.

Select Appropriate Indicators: Choose indicators that align with your goals. For instance, if you’re focusing on trend-following, moving averages might be suitable.

Test and Refine: Use backtesting to evaluate your strategy. Analyze the results and make necessary adjustments. Continuous refinement is key to long-term success.

By combining indicators and rigorously testing your strategies, you can enhance your trading approach. This methodical process will help you navigate the complexities of commodity trading with greater confidence.

https://04cb9mj6o8-seranvdq5ff8wdc.hop.clickbank.net

Technical indicators are vital in commodity trading. They provide insights into market trends and potential reversals. By applying these learned indicators, you can enhance your trading strategies and make informed decisions. Remember, successful trading requires continuous learning and adaptation. Experiment with different combinations of indicators to improve accuracy and reduce false signals. This approach helps you develop custom strategies that suit your trading style and goals. Embrace the journey of learning and refining your skills to achieve long-term success in the dynamic world of commodity trading.

FAQs

FAQ 1

Q: Which technical indicator is best for spotting commodity trends early?

A: The 50/200-day Moving Average crossover catches medium- to long-term trend shifts with minimal noise.

FAQ 2

Q: How can I time entries in volatile commodity markets?

A: Combine RSI (look for 30/70 swings) with MACD histogram reversals to confirm momentum before you pull the trigger.

FAQ 3

Q: Do these indicators work on all commodities?

A: Yes—crude, gold, or wheat, the same indicators apply; just adjust time-frames to each contract’s liquidity and trading hours.