Avoid Costly Mistakes in Cryptocurrency and Meme Stocks

You have likely seen gamestop in the news. The big changes in cryptocurrency and meme stocks seem exciting. But you need to be careful. Some people start trading without thinking about risks. Many regular investors get pulled into the hype about gamestop or other meme stocks. You may feel pushed to do what others are doing. But trading cryptocurrency and meme stocks is risky. Gamestop showed how prices can change very fast. Trading can quickly go wrong for regular investors. Be careful with every trade, and ask if you are ready for big price changes.

Key Takeaways

https://93799oj8-b6s9sf7zngjq4zrer.hop.clickbank.net

Meme stocks and cryptocurrencies can change prices very quickly, so always be ready for fast changes. Do your own research before you buy. Do not just listen to social media or what other people say. Only use money you can lose and do not let your feelings control your trades. Use risk tools like stop-loss orders, dollar-cost averaging, and diversification to keep your money safe. Keep your accounts safe with strong passwords, two-factor authentication, and by picking trusted platforms.

Volatility in Cryptocurrency and Meme Stocks

Price Swings

Prices in cryptocurrency and meme stocks can change quickly. These changes happen more often than with regular stocks. Meme stocks move because of social media and what retail investors think. Regular stocks usually change because of company news or earnings. In cryptocurrency, prices can shift because of new rules or Federal Reserve actions. This makes meme stocks and cryptocurrency much more jumpy than most other stocks.

Let’s see some of the biggest price changes from last year:

| Stock / Asset | Largest Recorded Price Swing / Return | Key Volatility Drivers / Notes |

|---|---|---|

| Palantir (PLTR) | 390% return over 12 months | Meme appeal, business growth, retail interest |

| Robinhood (HOOD) | Nearly 200% return over past year | Retail enthusiasm, fintech expansion |

| GameStop (GME) | Single-session rallies up to 7% | Social media influence, strategic moves |

| AMC Entertainment | High volatility, no exact % given | Debt load, retail trader interest |

| Trump Media (DJT) | Up to 50% single-session swings | Political news, extreme volatility |

| Tesla (TSLA) | Volatility driven by Elon Musk tweets | Strong fundamentals, social media-driven swings |

Tip: Always look for the reason a stock moves. Sometimes it is just hype, not real news.

https://60766mn7u77ynt57ketfyetkj9.hop.clickbank.net

Intraday and Overnight Risks

Risks can happen during the day and at night. Prices in cryptocurrency and meme stocks can change in just a few hours. News, big trades, or even one tweet can make prices jump. Cryptocurrency trades all the time, so you might wake up to a big change. Day traders often do not keep trades overnight because of these risks. You need to pay attention and think if you can handle sudden moves. If you trade these, remember big changes can happen anytime.

Lack of Research

Following Hype

You might get excited when everyone talks about a new meme stock or cryptocurrency. Social media can make you want to buy quickly. Many people do not do research and just copy others. This happens a lot on Reddit and Twitter. People share their thoughts and act with feelings. You might see others making money and feel left out. But this is dangerous. Studies show most regular investors lose money trading meme stocks like GameStop and AMC. They often trust social media more than real facts. This makes echo chambers, where people repeat the same ideas. You can get caught up in the excitement and forget to check the truth.

Tip: Always stop and ask, “Did I do my own research before buying this asset?”

Ignoring Fundamentals

When you trade meme stocks or cryptocurrencies, you might forget the basics. Fundamentals are things like company earnings, real profits, or the tech behind a coin. Meme assets often move away from their real value, especially during price bubbles or short squeezes. Social media can push prices far from what they should be. Look at this table to see how often these assets move away from their basics:

| Aspect | Evidence Summary |

|---|---|

| Frequency of deviation | Meme stocks and cryptocurrencies often move away from their real value during big price jumps like bubbles and short squeezes. |

| Nature of deviations | These changes are not always the same, and meme assets often cause big moves during strong price jumps. |

| Market conditions | When the market is falling, meme assets usually follow other assets, as investors look for safer places. |

| Role of social media | Social media attention from regular investors helps cause these changes and spreads the effects. |

| Implication | Moving away from basics is linked to guessing and feelings, not real value changes. |

If you skip research, you might buy at the highest price and lose money when prices drop. Always check the real value, not just the excitement. Good research helps you avoid losing money.

https://51b6all8o043cl17nmsm23x53e.hop.clickbank.net

Overinvesting in Meme Stocks

Risking More Than You Can Afford

You might feel excited when you see gamestop or other meme stocks making headlines. The idea of quick returns can make meme coin trading look easy. But meme stock mania often tricks you into risking more than you can afford. Many retail investors jump into trading because they want to catch the next big win. They see stories about huge returns from gamestop and think it will happen to them too.

Ask yourself: “If I lose this money, will it hurt my daily life?” If the answer is yes, you are taking on too much risk. Meme coin trading can wipe out your savings fast. Gamestop and other meme stocks can drop just as quickly as they rise. You should only use money you can afford to lose. This way, you protect yourself from the worst risks of meme stock mania.

Tip: Set a clear limit for how much you put into meme coin trading. Stick to your plan, even when meme stock mania is everywhere.

Emotional Decisions

Emotions can take over when you see gamestop or meme coin trading in the news. Meme stock mania makes it easy to forget about risks. You might think you are making smart moves, but feelings often lead to mistakes. Here are some common emotional triggers that cause overinvestment:

Fear of Missing Out (FOMO): You see others making money from gamestop or meme coin trading and rush in.

Emotional Attachment: You feel loyal to a stock or coin, like some investors do with gamestop.

Confirmation Bias: You look for news that supports your belief in meme coin trading and ignore warnings.

Herd Mentality: You follow the crowd during meme stock mania, just like many did with gamestop.

Overconfidence: You believe you can predict returns from meme coin trading better than others.

Regret Aversion: You buy into gamestop late, afraid of missing out on more returns.

Loss Aversion: You hold onto meme stocks or meme coin trading positions, hoping for a rebound.

Availability Bias: You hear about gamestop and meme coin trading everywhere, so you think the returns are easy.

Meme stock mania can cloud your judgment. If you let emotions guide your trading, you may face bigger risks and lose more than you expect. Stay calm, review your plan, and remember that meme coin trading is never a sure thing.

Poor Risk Management Strategies

When you trade meme stocks or cryptocurrencies, you need strong risk management. If you skip these strategies, you might lose money fast. Let’s look at three common mistakes and how you can avoid them.

No Stop-Loss Orders

Stop-loss orders help you control losses. You set a price where your trade will close if things go wrong. Many traders forget to use stop-loss orders, hoping prices will bounce back. That’s risky. Studies show about 70% of successful traders use stop-loss strategies. Here’s why stop-loss orders matter:

They protect your money during big price swings.

You don’t have to watch prices all day.

They remove emotions from your trading strategies.

You can use tools like support levels or moving averages to set smart stop-loss points.

Trailing stop-loss orders let you lock in profits as prices rise.

Tip: Review your stop-loss settings often. Don’t set them too tight or too loose. Use trading bots if you want help.

Ignoring Dollar-Cost Averaging

Dollar-cost averaging (DCA) means you invest a set amount at regular times. You don’t try to guess the best time to buy. This strategy lowers your risk and helps you avoid buying at the highest price. Check out this table to see how DCA helps:

| Study / Author(s) | Key Finding |

|---|---|

| Trainor (2005) | DCA reduces the chance of big losses compared to lump-sum investing. |

| Brennan, Li, and Torous (2005) | DCA works well when you add stocks to a mixed portfolio. |

| Milevsky and Posner (2003) | DCA can give better returns for volatile stocks than lump-sum investing. |

DCA also helps you stay calm. You don’t worry about market swings as much. Over time, you build a safer portfolio.

Lack of Diversification

If you put all your money in one meme stock or coin, you take on too much risk. Diversification means you spread your money across different assets. Research shows that adding more cryptocurrencies or meme stocks to your portfolio lowers risk and can improve returns. Meme assets often move differently than regular stocks, so mixing them can help balance your portfolio.

Investment tips: Try to include different types of assets in your portfolio. Don’t rely on just one coin or stock. Diversification and dollar-cost averaging together make your trading strategies stronger.

How to Avoid Coin Scams

You want to keep your money safe when you try meme coin trading. The crypto world has a big potential for scams, so you need to know what to watch out for. Many people lose money because they trust hype or rush into new coins. Let’s break down how to spot scams and protect yourself.

Spotting Pump-and-Dump Schemes

Pump-and-dump schemes are everywhere in meme coin trading. Scammers pick coins with low liquidity and little popularity. They use social media like Twitter, Telegram, and Discord to create hype. You see paid influencers and bots posting about the coin. The price jumps fast because people feel FOMO and want quick profits. Then, the scammers sell their coins, and the price crashes. You get stuck with losses.

Here’s a table showing common signs of pump-and-dump schemes:

| Characteristic | What to Look For |

|---|---|

| Token Type | New coins with low liquidity and little history |

| Promotion Method | Hype on social media, paid posts, and fake endorsements |

| Price Behavior | Sudden price spikes followed by sharp drops |

| Anonymity | Creators hide their identity |

| Malicious Code | Honeypot code that traps investors |

| Financial Impact | Millions lost by buyers, big profits for scammers |

If you see a coin with a huge price jump and lots of hype but no real news, stop and do meme coin analysis. Ask yourself if the project is transparent. Don’t let FOMO push you into meme coin trading without research.

Recognizing Fraudulent Projects

Scams in meme coin trading come in many forms. You see fake ICOs, Ponzi schemes, phishing attacks, and fake exchanges. Scammers promise high returns and use confusing language. They pressure you to invest right away. You get offers from unknown people or see projects with no real team. Regulators say you should watch for these warning signs:

Promises of “guaranteed” or risk-free profits

Vague or missing whitepapers

Poor security, like no two-factor authentication

Unlicensed sellers or unregistered firms

Sudden price spikes with no reason

To avoid scams, always verify legitimacy before you invest. Check if the team is real and if the project follows rules like KYC and AML. Read the whitepaper and look for real use cases. Search online for scam alerts. Never invest money you can’t afford to lose. Careful meme coin analysis helps you spot scams and keep your money safe.

Tip: If an offer sounds too good to be true, it probably is. Take your time and do your own research.

Security Mistakes

Weak Passwords

Some people think their password is strong, but hackers can break weak ones fast. Many new crypto investors use easy passwords like “123456” or “password.” Some forget to turn on two-factor authentication, which adds extra safety. If you skip these steps, it is easy for someone to steal your money. A survey from Georgia Tech showed most beginners do not care about password safety and forget to save their seed phrases on paper. You should never give your private keys or seed phrases to anyone. Always make your password with letters, numbers, and symbols. Try not to use the same password for more than one account.

Tip: Write your seed phrase on paper and hide it in a safe place. Do not keep it on your phone or computer.

Here are some mistakes you should not make:

Using weak passwords or the same password for everything.

Not turning on two-factor authentication.

Sharing private keys or seed phrases with others.

Not saving your seed phrase on paper.

Clicking on strange links or downloading unknown apps.

Unsafe Platforms

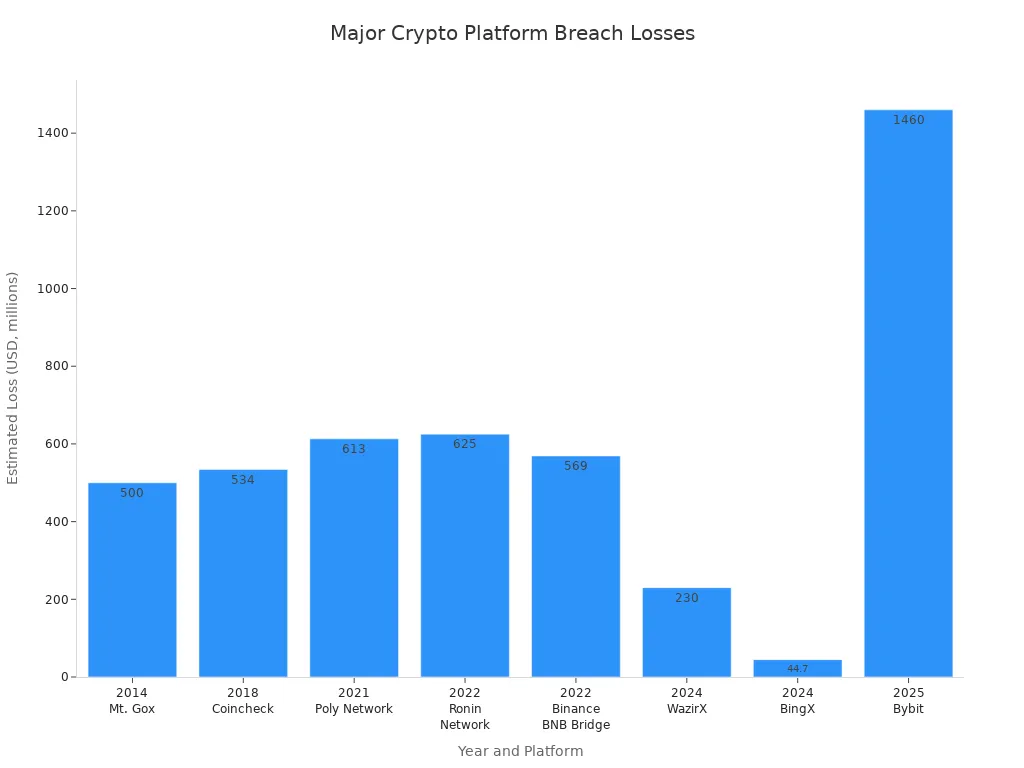

You might want to try new exchanges or wallets because they look simple. But unsafe platforms can lose your money if they get hacked. Big crypto platforms get hacked every year, and a lot of money is lost. In 2024, hackers took $2.2 billion from big exchanges. The Bybit hack in 2025 lost $1.46 billion. These hacks happen because of bad wallet care, weak security, and smart contract problems.

If you keep your coins on an exchange, you could lose them all in a hack. Always read reviews and see what other users say before picking a platform. Move your coins to a hardware wallet to keep them safe for a long time. Update your apps and wallets often to stay safe.

Note: Hackers go after weak platforms and careless users. You can stay safe by picking strong platforms and using good passwords.

Timing the Market

Dangers of Market Timing

You might think you can guess the best time to buy or sell meme stocks or cryptocurrencies. Many people try to jump in and out of the market, hoping for quick returns. But timing the market is much harder than it looks. Most traders lose money when they chase price swings. Research shows only about 3% of day traders make a profit, and just 1% do so consistently. After five years, almost all day traders lose money. Meme stocks like GameStop and AMC saw wild price jumps because of online communities. These groups often tell you to hold your position no matter what, using phrases like “diamond hands.” Sometimes, trading platforms even stop trading without warning, leaving you stuck.

Cryptocurrencies can swing more than 40% in just a few months. This makes them risky and unpredictable. You might see big returns one day and huge losses the next. If you try to time these moves, you could end up with less money than you started. The table below shows how hard it is to make money by timing the market:

| Metric/Context | Statistic/Insight |

|---|---|

| Overall day trader profitability | About 3% make a profit; only 1% do so predictably |

| Day traders profitable after 6 months | 13% |

| Day traders profitable after 5 years | 1% |

| FINRA reported losses | 72% of day traders ended the year with losses |

| Meme stock surge (2021) | $4.13 billion in trading costs from inexperienced traders |

Tip: If you feel pressure to make fast trades, step back and review your strategies. Quick moves often lead to poor returns.

Benefits of Staying Consistent

You do not need to guess every market move to get good returns. Staying consistent with your trading strategies helps you avoid big mistakes. When you invest a set amount regularly, you lower your risk. This approach is called dollar-cost averaging. You do not worry about catching the perfect price. Over time, you build your portfolio and avoid chasing hype.

Consistent trading lets you focus on long-term returns instead of short-term wins. You can use strategies like setting stop-loss orders and diversifying your assets. These steps help you manage risk and keep your money safer. Successful traders use discipline and stick to their plan. They do not let fear or greed control their decisions.

Set clear goals for your trading.

Use proven strategies to manage risk.

Track your results and adjust your plan if needed.

Note: You will not win every trade, but steady strategies give you a better chance at positive returns.

Staying Informed and Active Strategies

Tracking Credible Sources

You need good information to make smart trading choices. Not all sources are equal. Some give you facts, while others just spread rumors. If you want to keep up with meme stocks and cryptocurrencies, start by following these trusted places:

Social media platforms like X (formerly Twitter) and Reddit help you see what people think about meme coins. These sites show trends and public mood fast.

Market data sites such as CoinGecko and CoinMarketCap give you real-time numbers. You can check market cap, trading volume, and price changes.

Licensed crypto exchanges like Crypto.com and Uphold offer safe trading and up-to-date news.

Mainstream exchanges such as FTX and Coinbase make it easy for you to buy and sell. They also share important updates.

Listen to experts like Daniel Polotsky from CoinFlip. He says you should look for transparency and active communities when picking meme coins.

Tip: Always double-check news before you act. If something sounds too good to be true, it probably is.

Using Hedging and Liquidity

Volatility can shake your confidence in trading. You can use strategies to protect yourself. Hedging and keeping enough liquidity are two smart moves.

Hedging helps you balance risk. You can use options, futures, or swaps to offset possible losses. Some traders use stablecoins to move out of risky assets when prices drop. This keeps your money safe during wild swings.

Crypto products like Shark Fin or Dual Investment give you more ways to manage risk. They work like insurance for your investments.

Market making bots play a big role in liquidity. They place buy and sell orders all the time. This means you can enter or exit trades quickly, even when the market moves fast.

Good liquidity narrows the gap between buy and sell prices. It helps you avoid big losses from sudden price jumps.

Keeping some cash or stablecoins ready gives you flexibility. You can react to new chances or protect your portfolio if things go wrong.

Note: Strong liquidity and hedging tools make trading safer. You can plan better and worry less about sudden changes.

Trading meme stocks or cryptocurrencies can be very risky. Some of the worst mistakes are following hype, not looking at company basics, and trusting social media too much. Experts say most traders lose money because they do not do research, act with feelings, or sell at the wrong time. To stay safe, use good risk management, keep learning new things, and always check where your information comes from. Trading in these markets can feel fun and exciting, but you must be extra careful to avoid losing money. Be alert and make smart choices! 🚦

https://fiscalfitnessflow.com/index.php/2025/06/10/investor-behavior-psychology-behind-investment-decisions/

FAQ

What is a meme stock?

A meme stock is a company’s stock that gets popular online. You see people talk about it on social media. The price can jump fast because lots of people buy it for fun or hype.

How do I protect my crypto from hackers?

You should use strong passwords and turn on two-factor authentication. Store your coins in a hardware wallet. Never share your private keys. Update your apps often.

Can I lose all my money trading meme coins?

Yes, you can lose everything. Meme coins are risky. Prices change quickly. If you invest more than you can afford, you might lose it all. Always set limits and do your research.

Why do prices swing so much in crypto?

Crypto prices move fast because of news, social media, and big trades. The market never sleeps. You might see huge changes in just a few hours or overnight.

Should I follow social media tips for trading?

You should not trust every tip you see online. Many posts are just hype. Always check facts and do your own research before you buy or sell anything.