Fintech Innovations Set to Redefine Banking

Digital-Only Banking and Fintech Innovations: I see digital-only banking and fintech innovations accelerating rapidly. I track trends like the 94% jump in RTP payments and 184 million P2P payment users in the US. These shifts are transforming banking, customer experience, and finance. The future of financial technology demands continuous innovation, digital finance solutions, and seamless customer banking experiences.

| Indicator / Trend | Statistic | Description |

|---|---|---|

| P2P Payment Users in US | 184 million by 2026 | Rapid digital payment adoption |

| RTP Payment Growth | 94% increase to $246B | Instant payment rails gain traction |

| FedNow Participation | Over 1,200 institutions | Real-time banking infrastructure expands |

| Fintech Startup Funding | $314 billion in 2024 | Investor confidence in fintech rebounds |

Key Takeaways

Digital-only banks are growing fast, offering customers easy, anytime access to personalized banking without physical branches, which lowers costs and improves service.

AI is changing banking by personalizing customer experiences, predicting needs, and automating compliance, making banking safer, faster, and more customer-friendly.

Embedded finance and open banking connect financial services with everyday platforms, boosting convenience, customer loyalty, and creating new business opportunities.

Digital-Only Banking and Fintech Innovations

Rise of Digital-Only Banks

I have watched digital-only banking and fintech innovations reshape the financial landscape. Digital banking has grown at a remarkable pace. Today, there are 235 licensed digital banks worldwide. These banks focus on digital channels and offer customizable banking that traditional banks struggle to match. I see digital banking trends showing a forecasted net interest income of $1.61 trillion in 2025, with a 7.1% growth rate. Digital-only banks use technology to deliver financial services faster and more efficiently. They operate without physical branches, which reduces costs and allows for more customer-centric solutions.

Impact on Customer Experience

Digital banking puts the customer at the center of every decision. I notice that digital-only banking and fintech innovations have made banking more accessible and affordable. Customers can open accounts, transfer funds, and access financial services anytime. Customizable banking features let customers personalize their digital banking experience. Many digital banks offer real-time notifications, budgeting tools, and instant support. These trends have improved customer experience by making banking more transparent and responsive. I see a shift toward a customer-centric model, where customer experience drives every innovation.

Digital banking trends show that customers now expect seamless, digital-first, and customizable banking options.

Future of Digital Banking

Looking ahead, I expect digital banking to keep evolving. Fintech will drive more customizable banking products and services. I believe digital-only banking and fintech innovations will continue to set new standards for customer experience. As digital banking trends accelerate, banks must focus on customer-centric and customizable banking to stay competitive. The future of banking will rely on digital solutions that adapt to changing customer needs and deliver superior customer experiences.

AI-Driven Innovation

Personalization in Digital Banking

I see AI-driven innovation transforming digital banking through hyper-personalized banking experiences. AI and machine learning analyze customer data from every digital interaction. This lets banks deliver personalized offers, dynamic product recommendations, and tailored financial advice. The impact is clear:

| Metric / Outcome | Evidence / Statistic | Impact / Explanation |

|---|---|---|

| Customer Satisfaction Improvement | 25% increase in satisfaction scores reported by banks using AI-driven personalization (Accenture, 2023) | AI analyzes diverse customer data to tailor interactions, improving overall satisfaction and faster query resolution. |

| Cross-Selling Success | 20-30% increase in cross-selling success rates through advanced personalization (BCG, 2022) | Personalized offers based on transaction history and life events increase relevance and timing of product recommendations. |

| Customer Engagement | 76% of consumers more likely to engage with brands that personalize digital communications (McKinsey, 2021) | Personalized push notifications can increase interaction rates by up to 7 times compared to generic alerts. |

| Mobile Banking Adoption | 72% of consumers value personalized experiences in mobile banking apps; 30% higher satisfaction reported (J.D. Power, 2023) | Personalized features like spending insights and goal tracking drive a 31% year-over-year increase in active users. |

| Customer Churn Reduction | 10-15% reduction in churn with comprehensive personalization strategies (Gartner, 2023) | Personalized retention offers and re-engagement campaigns help preserve significant revenue by reducing churn. |

| Core Technologies | Predictive analytics and machine learning enable hyper-personalized recommendations anticipating customer needs | These technologies allow banks to move from descriptive to predictive and prescriptive analytics, enhancing personalization depth. |

I have seen digital banking apps use ai-driven analytics to boost customer-centric engagement and retention.

https://fiscalfitnessflow.com/index.php/2025/06/10/investor-behavior-psychology-behind-investment-decisions/

Predictive Services

AI-driven innovation powers predictive services in digital banking. I notice banks now use machine learning models trained on vast data, including credit history, utility payments, and even smartphone usage. These models spot patterns that traditional methods miss. They enable dynamic credit limits, auto-approved loans, and real-time risk assessments. AI-driven credit scoring also helps more people access digital banking by evaluating those with limited credit histories. AI models adapt as new data arrives, making predictions more accurate and relevant.

AI-powered credit scoring uses alternative data sources.

Models identify complex patterns for dynamic risk prediction.

AI reduces bias and speeds up digital banking decisions.

Machine learning uncovers associations that improve predictive accuracy.

AI-driven innovation supports financial inclusion and customer trust.

Compliance Automation

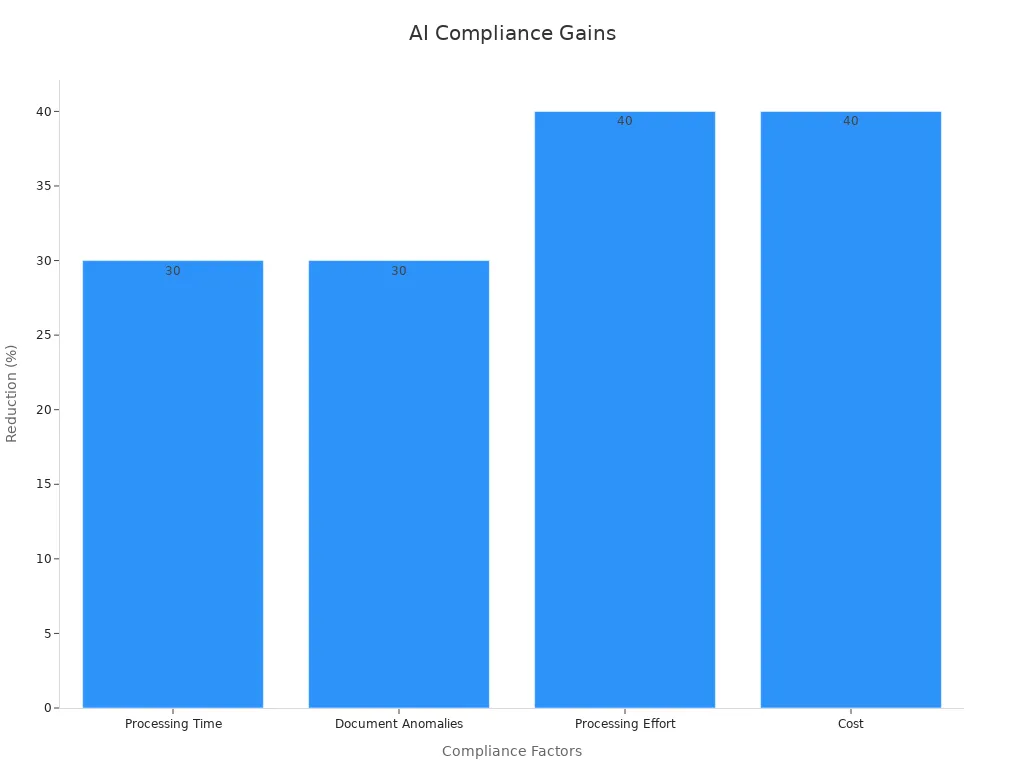

I have watched compliance automation become a game-changer for digital banking. AI processes huge volumes of data, reducing manual errors and speeding up regulatory checks. The results speak for themselves:

| Aspect | Traditional Non-AI Compliance | AI-Driven Compliance Automation |

|---|---|---|

| Data Processing Capacity | Limited, reliant on spreadsheets and manual input | Advanced, capable of handling vast data volumes |

| Error Rates | High due to human error and manual processes | Significantly reduced through AI precision and learning |

| Processing Time | Time-consuming manual updates and verifications | Automated routine tasks reduce cycle time by 30% |

| Document Anomalies | Frequent inconsistencies and errors | 30% reduction in document anomalies |

| Processing Effort | High manual effort | 40% reduction in processing effort |

| Cost | Higher due to inefficiencies | 40% cost reduction |

| Compliance Monitoring | Reactive, manual | Real-time monitoring and predictive compliance |

| Regulatory Change Management | Slow adaptation | Faster, proactive response enabled by AI |

AI-driven compliance automation in digital banking reduces regulatory errors, cuts costs, and improves efficiency. I expect digital banking to keep evolving as ai-driven innovation unlocks new levels of personalization, predictive services, and compliance.

Embedded Finance and BaaS

Integration with Non-Financial Platforms

I have seen fintech transform how companies deliver finance solutions. Non-financial platforms now embed payments, loans, and banking directly into their user experiences. APIs and Banking-as-a-Service make this possible. For example, ride-hailing apps let drivers access instant pay, and e-commerce sites offer buy-now-pay-later at checkout. These integrations reduce friction for the customer and keep users engaged within the platform. Businesses gain valuable data insights and new revenue streams. However, I notice that companies must address regulatory compliance and data privacy challenges as they adopt these finance innovations.

Customer Engagement

Embedded finance increases customer engagement by making financial services part of everyday workflows. I see platforms like Shopify and Uber use fintech to offer instant payments, credit, and banking tools. Customers benefit from faster checkouts, instant earnings, and seamless access to finance. The table below highlights how embedded finance boosts engagement and satisfaction across industries:

| Industry/Platform | Embedded Financial Service Examples | Key Outcomes |

|---|---|---|

| E-commerce (Shopify) | Shop Pay, Shopify Capital, Shopify Balance | 70% faster checkout, 18% higher conversion rates |

| Transportation (Uber) | Instant pay, Uber Cash, driver banking | 70% driver usage, 36% higher satisfaction |

| B2B Marketplace | Trade financing, payment solutions | 43% less friction, 29% better seller cash flow |

| Market-wide | Consumer adoption, business impact | 78% reuse, 26% higher retention, 21% revenue gain |

I believe fintech-driven finance integration leads to higher customer loyalty and operational efficiency.

Business Opportunities

I track market research that projects embedded finance to reach $291.3 billion by 2033, up from $22.5 billion in 2020. This growth creates major opportunities for fintech and non-financial companies. I have seen case studies where partnerships, like FreshBooks and YouLend, enable embedded lending and faster loan approvals. Embedded finance lets businesses create new revenue streams, improve customer experience, and compete more effectively. I expect fintech to keep driving innovation as more companies adopt embedded finance and BaaS models.

Open Banking and DeFi

Data Control

I have seen a major shift in how customers control their financial data. Open banking policies now exist in 49 countries, giving people more power over their information. When customers can choose who accesses their data, they gain better access to financial services and advice. I notice that small businesses use open banking to build new lending relationships. This trend improves the overall welfare of the financial system. Open banking also reduces adverse selection in credit, which means lenders can make better decisions. However, I see that privacy preferences still shape adoption rates. Customers who value privacy may face higher prices, but the benefits of increased competition and product improvements remain clear.

Interoperability

Interoperability stands at the core of financial infrastructure disruption. I watch as open banking and decentralized finance (DeFi) platforms connect different financial services. This connection allows customers to move data and money across banks, fintechs, and other providers. I see banking trends moving toward seamless integration, which makes finance more efficient. Interoperability supports new financial services trends, such as instant payments and cross-platform lending. It also encourages more fintech companies to enter the market, which drives innovation and competition.

Regulatory Trends

Regulatory filings and open data sets support the rapid growth of open banking and DeFi. I track several important regulations shaping these banking trends:

The EU’s PSD2 requires banks to share customer data with third parties, with consent.

The UK’s CMA mandates open banking standards for major banks.

Australia’s Consumer Data Right (CDR) sets a framework for data sharing.

Asian regions develop their own open banking frameworks.

In the US, the CFPB proposes rules to speed up open banking adoption and protect consumers.

These regulations enable secure data sharing, increase transparency, and foster competition. I believe these financial services trends will continue to disrupt financial infrastructure and reshape the future of finance.

Green Fintech

Sustainable Products

I have seen green fintech drive the creation of sustainable financial products. Many banks and fintech companies now offer green bonds, eco-friendly loans, and investment platforms focused on environmental, social, and governance (ESG) goals. These products help customers support renewable energy, clean technology, and sustainable agriculture. I notice that fintech makes it easier for people and businesses to access capital for green projects. Digital platforms also improve the quality and availability of environmental data, which lowers costs and risks for investors. As a result, more people can invest in projects that help the planet.

Environmental Impact

Green fintech plays a key role in improving environmental outcomes. I track studies that show a positive link between fintech activity and better social-environmental performance across many countries. For example, in China, financial technologies have helped reduce CO2 emissions and promote green finance, even as the country relies on coal. Fintech supports ESG investing by making information more available and lowering costs. Over time, these efforts lead to cleaner energy, less pollution, and smarter use of resources. The impact grows as more banks adopt green fintech and as regulatory frameworks develop.

A composite Social-Environmental Index measures progress in sustainability.

Fintech finance data from 58 countries shows a positive association with environmental performance.

Fintech adoption by banks boosts green investment and reduces emissions.

Adoption Challenges

I see several challenges slowing the adoption of green fintech. Many countries need stronger regulations and better digital infrastructure. Some investors still lack trust in new green products. The impact of fintech on the environment takes time, as people and businesses must change their habits. I believe that as trends in green fintech continue, more companies will invest in digital solutions for sustainability. Education, clear rules, and support from governments will help overcome these barriers and speed up progress.

Cybersecurity and RegTech

Fraud Detection

I have seen fraud threats grow more complex each year. Fintech companies now use advanced analytics and AI-based machine learning models to spot fraud in real time. These tools process huge amounts of data and find subtle patterns that humans might miss. I notice that companies benchmark their fraud detection by tracking false positives, detection speed, and how quickly they close cases. This helps them improve their AI models over time. Many firms also share fraud intelligence through APIs and networks, which strengthens their defenses. Security frameworks like PCI DSS and OWASP set standards for measuring fraud prevention. Industry reports show that fraud losses remain high, so I believe continuous improvement in detection is critical.

Digital Identity

Digital identity sits at the heart of secure fintech operations. I have tracked a 73% increase in identity fraud cases in fintech from 2021 to 2023. This surge brings serious risks, including financial loss, damaged credit, and even links to international crime. Data breaches can disrupt operations and erode customer trust. Insider threats from employees or contractors add another layer of risk. To protect digital identities, I recommend using ID scanning, encryption, multi-factor authentication, and strict access controls. Privileged access management also helps prevent abuse.

I always stress the need for strong digital identity safeguards to protect both customers and companies.

Regulatory Compliance

Regulatory compliance shapes every cybersecurity strategy in fintech. I see companies invest in automated tools to keep up with changing rules and reduce manual errors. Compliance with security frameworks not only protects data but also builds trust with customers. I believe that as threats evolve, fintechs must stay agile and proactive in meeting regulatory demands. This approach helps prevent costly breaches and keeps the financial ecosystem safe.

Future Payment Solutions

Virtual Cards

I have seen virtual cards become a core part of digital banking. These cards exist only in digital form and work for online or mobile payments. I use virtual cards to protect my main account details. Many banks now offer instant issuance of digital cards. Customers can generate new card numbers for each transaction. This feature reduces fraud risk and gives users more control. I notice that digital cards also support spending limits and easy cancellation. Businesses use them for employee expenses and online subscriptions. Virtual cards help streamline digital payments and improve security.

Real-Time B2B Payments

Real-time B2B payments have changed how companies move money. I watch as digital payment rails enable instant transfers between businesses. This speed helps companies manage cash flow better. I see fewer delays and less reliance on paper checks. Many digital platforms now offer real-time settlement and automated reconciliation. These features reduce errors and save time. Companies can track payments and resolve issues quickly. Real-time B2B payments support global trade and digital commerce.

Digital Wallets

Digital wallets have become essential for both consumers and businesses. I use digital wallets to store cards, make contactless payments, and manage loyalty programs. Many digital wallets now support cryptocurrencies and peer-to-peer transfers. I see digital wallets driving financial inclusion by reaching people without traditional bank accounts. Security features like biometric authentication protect user data. Digital wallets also integrate with other digital services, making them a hub for daily transactions.

I believe digital payment solutions will keep evolving to meet new demands and improve user experience.

The Future of Digital Banking

Platformization

I see platformization shaping the future of banking. Banks now build digital ecosystems that connect customers, fintechs, and third-party providers. These platforms offer a wide range of services, from payments to insurance, all in one place. I notice that banks who adopt this model can respond faster to customer needs. They also create new revenue streams by partnering with digital service providers. The future will see more banks acting as digital hubs, not just financial institutions. This shift will define the bank of the future and help banks stay relevant in a fast-changing world.

Super Apps

Super apps have become a major trend in the digital banking space. I have studied how these apps combine many services, such as messaging, shopping, and banking, into a single digital platform. Real-world data shows how customer engagement shapes the future of super apps:

A survey of 764 potential super app adopters in Germany revealed five main consumer groups: Urban Explorers, Efficiency Experts, the Versatile Majority, Digital Enthusiasts, and the Golden Triangle.

The most popular services in super apps are e-commerce, social media, and banking.

Successful super apps focus on the most demanded features, not just a large number of options.

Customer preferences and engagement trends drive the future of these digital platforms.

I believe super apps will play a key role in the future of banking by meeting diverse customer needs in one digital space.

Quantum and Blockchain

Quantum computing and blockchain technology will transform the digital future. I see quantum computers solving complex problems in seconds, making digital transactions faster and more secure. Blockchain brings transparency and trust to digital banking. The bank of 2030 will use these tools to protect data and improve efficiency. I expect the future of banking to rely on these digital innovations to deliver safer and smarter services.

I see fintech and digital-only banking shaping new banking trends. To stay ahead, I recommend banks and fintechs focus on agility and continuous innovation.

By 2030, scale and open-source platforms will drive the future.

Generative AI will cut costs and enable customer-centric trends.

I expect the future of banking to reward those who adapt quickly.

FAQ

What is the biggest benefit of digital-only banks?

I see digital-only banks offer unmatched convenience. Customers can access accounts, transfer money, and get support anytime, anywhere. No need to visit a branch.

How does AI improve banking security?

AI detects fraud by analyzing patterns in real time. I trust AI to spot unusual activity faster than humans. This keeps accounts and transactions safer.

Can embedded finance help small businesses?

Absolutely! I have seen embedded finance give small businesses instant access to loans, payments, and banking tools. This helps them grow and manage cash flow more easily.