Financial Inclusion Initiatives: Bridging the Gap

Financial inclusion initiatives have become increasingly important in today’s global economy. These initiatives aim to provide individuals and communities with access to basic banking and financial services, addressing the issue of financial exclusion that many people face. By promoting financial inclusion, these initiatives seek to bridge the gap between the unbanked or underbanked population and the formal financial system, ultimately driving economic growth and reducing poverty levels.

What are Financial Inclusion Initiatives?

Financial inclusion initiatives refer to a set of policies, programs, and efforts that aim to promote access to financial services for all individuals, regardless of their income level or location. These initiatives are designed to ensure that everyone has the opportunity to save, borrow, invest, and protect themselves against financial risks.

Key takeaways from financial inclusion initiatives include:

Accessibility: Financial inclusion initiatives focus on making financial services accessible to individuals and communities that have historically been excluded from the formal financial system.

Equality: These initiatives aim to create a level playing field by ensuring that marginalized populations have equal access to financial services.

Empowerment: Financial inclusion initiatives enable individuals to take control of their financial lives, promoting economic empowerment and reducing inequalities.

Understanding the Importance of Financial Inclusion

Financial inclusion plays a crucial role in promoting economic growth and reducing poverty levels. When individuals have access to formal financial services, they can better manage their income, save for the future, access credit for investment opportunities, and protect themselves against financial shocks. Financial inclusion also contributes to greater financial stability, as it reduces the reliance on informal and often unreliable financial channels.

Moreover, financial inclusion has a positive impact on various social and economic factors. It promotes gender equality by giving women greater control over their finances and reducing their vulnerability to financial abuse. It also enhances entrepreneurship and job creation by providing individuals with the necessary financial tools to start and grow businesses. Overall, financial inclusion has the potential to transform individuals’ lives, communities, and entire economies.

The Impact of Financial Inclusion Initiatives

Financial inclusion initiatives have proven to have a significant impact on individuals and communities. By providing access to financial services, these initiatives help individuals build assets, accumulate savings, and improve their overall financial well-being. Studies have shown that when people have access to formal financial services, they are more likely to invest in education, improve their housing conditions, and make better health-related choices.

Financial inclusion initiatives also contribute to poverty reduction. By giving individuals the tools to save and invest, these initiatives help them increase their income and lift themselves out of poverty. It has been observed that better access to financial services leads to increased income-generating activities, especially in rural and underserved areas. Additionally, financial inclusion helps individuals cope with emergencies and unexpected events by providing them with insurance and risk management options.

Types of Financial Inclusion Initiatives

Financial inclusion initiatives come in various forms, each addressing specific barriers to financial access.

Some of the common types of financial inclusion initiatives include:

Mobile Banking and Digital Wallets:

Mobile banking is a technology-driven initiative that allows individuals to perform basic banking transactions through their mobile devices. This approach has revolutionized banking in many developing countries, where traditional banking infrastructure is limited. Digital wallets, on the other hand, provide a virtual platform for individuals to store and transfer funds electronically, reducing the need for physical cash.

Microfinance and Microloans:

Microfinance initiatives provide small loans and other financial services to low-income individuals and entrepreneurs who would otherwise have limited access to credit. By offering loans with manageable interest rates and flexible repayment terms, microfinance institutions empower individuals to start or expand small businesses, generate income, and build financial stability.

Government Programs and Policies:

Many governments around the world have introduced programs and policies to promote financial inclusion. These initiatives can include creating incentives for financial institutions to reach underserved populations, implementing financial literacy programs, and establishing regulatory frameworks that protect consumers while promoting inclusion.

How Financial Inclusion Initiatives Work

Financial inclusion initiatives work by addressing the barriers that prevent people from accessing financial services. These barriers can include geographic limitations, lack of identification documents, limited financial literacy, and affordability issues. Initiatives are designed to overcome these barriers and create an inclusive financial system that serves the needs of all individuals.

Efforts to promote financial inclusion often involve collaborating with various stakeholders, including financial institutions, government agencies, NGOs, and technology providers. By leveraging technology, such as mobile banking platforms and digital payments, financial inclusion initiatives can reach individuals in remote areas and offer them convenient, low-cost financial services.

Key Factors that Drive Financial Inclusion

Several factors contribute to the success and effectiveness of financial inclusion initiatives.

These factors include:

Collaboration and Partnership:

Financial inclusion initiatives require collaboration among various stakeholders, including government agencies, financial institutions, NGOs, and the private sector. By working together, these entities can leverage their resources and expertise to address the multifaceted challenges of financial exclusion.

Technological Innovation:

Technology plays a crucial role in advancing financial inclusion. Mobile banking, digital wallets, and other digital solutions have made it easier and more affordable for individuals to access financial services. Innovations in identification technology, such as biometrics, have also facilitated the opening of bank accounts for individuals who may lack traditional identification documents.

Financial Literacy and Education:

Promoting financial literacy and education is key to ensuring that individuals can effectively use financial services. Financial inclusion initiatives often include initiatives to improve financial literacy, such as offering financial education programs and providing tools for individuals to make informed financial decisions.

Regulatory Environment:

A supportive regulatory environment is essential for the success of financial inclusion initiatives. Governments need to create an enabling framework that encourages financial institutions to reach underserved populations while ensuring consumer protection.

The Role of Technology in Financial Inclusion

One of the key drivers of financial inclusion is the advancements in technology. Technology has played a transformative role in expanding access to financial services, particularly in developing countries with limited traditional banking infrastructure. Two significant technological advancements that have contributed to financial inclusion are mobile banking and digital wallets.

Mobile Banking and Digital Wallets

Mobile banking allows individuals to perform basic banking transactions, such as depositing, withdrawing, and transferring funds, through their mobile devices. This technology has revolutionized banking services by extending access to remote and underserved areas. Mobile banking offers convenience, speed, and cost-effectiveness, as individuals can perform transactions without physical interaction with a bank branch.

Digital wallets, on the other hand, provide individuals with a virtual platform to store and transfer funds electronically. Individuals can use digital wallets to make payments for goods and services, send money to family and friends, and even receive government benefits. Digital wallets are particularly beneficial in regions where cash is the dominant form of payment, as they reduce the reliance on physical currency.

How mobile banking is driving financial inclusion

Mobile banking is driving financial inclusion by overcoming traditional banking limitations, such as limited brick-and-mortar branches and the cost of operating bank accounts. By leveraging mobile technology, individuals can access financial services without the need for physical bank branches. This is particularly beneficial for individuals in rural and remote areas, who may have limited access to traditional banking infrastructure.

Mobile banking also allows individuals to perform transactions at their convenience and avoids the need for physical cash. This not only increases the security of financial transactions but also reduces the costs associated with cash handling and transportation.

The benefits of digital wallets in expanding financial access

Digital wallets have proven to be powerful tools for expanding financial access, especially for individuals who may not have access to traditional banking services. These wallets enable individuals to store and transfer funds digitally, reducing the reliance on cash and offering convenience in making transactions.

Some of the key benefits of digital wallets include:

Increased financial inclusion:

Digital wallets provide individuals with a secure and accessible platform to manage their finances, even without a traditional bank account. This expands financial access to individuals who may not meet the requirements for opening a bank account, such as those without official identification documents.

Lower transaction costs:

Digital wallets often have lower transaction costs compared to traditional banking methods. This makes financial services more affordable and accessible for individuals with limited financial resources.

Enhanced financial security:

Digital wallets offer advanced security features, such as transaction authentication and encryption, protecting individuals’ funds against theft and fraud. This provides individuals with increased confidence in using digital financial services.

Microfinance and Microloans

Microfinance initiatives have played a critical role in promoting financial inclusion, especially in developing countries. These initiatives provide small loans and other financial services to low-income individuals who do not have access to traditional banking services. Microfinance institutions often serve as alternatives to formal banks, offering loans with manageable interest rates and flexible repayment terms.

Microloans enable individuals to start or expand small businesses, generating income and improving their financial well-being. By providing individuals with the necessary capital and financial knowledge, microfinance initiatives empower individuals to become entrepreneurs, create jobs, and contribute to local economic development.

Government Programs and Policies

Governments around the world play a crucial role in promoting financial inclusion through various programs and policies. These initiatives can range from incentivizing financial institutions to reach underserved populations to implementing financial literacy programs and creating regulatory frameworks that protect consumers while promoting inclusion.

Government programs and policies help address the systemic barriers that prevent individuals from accessing financial services. For example, governments may establish partnerships with financial institutions to ensure the provision of basic banking services in underserved areas. They may also develop financial education programs to enhance individuals’ financial literacy and empower them to make informed financial decisions.

Challenges and Barriers to Financial Inclusion

While financial inclusion initiatives have made significant progress, several challenges and barriers still hinder efforts to achieve universal financial access.

Some of the key challenges include:

Lack of financial infrastructure: Many underprivileged communities lack basic financial infrastructure, such as bank branches and ATMs, making it difficult for individuals to access financial services.

Limited documentation: In many developing countries, a significant proportion of the population lacks proper identification documents, making it challenging to open bank accounts and access formal financial services.

Low financial literacy: A lack of financial literacy and understanding of financial services can hinder individuals’ ability to utilize financial products effectively.

Affordability: High account maintenance fees, transaction costs, and minimum deposit requirements can be barriers for individuals with limited financial resources.

Gender inequality: Women, in particular, face higher barriers to financial inclusion due to social and cultural biases, limited access to education, and legal barriers.

Overcoming Challenges and Achieving Sustainable Financial Inclusion

To overcome the challenges and achieve sustainable financial inclusion, it is crucial to adopt a holistic approach that addresses the multifaceted nature of the barriers.

Key strategies to overcome these challenges include:

Enhancing financial literacy: Governments, financial institutions, and NGOs should collaborate to provide financial education programs that improve individuals’ understanding of financial services, budgeting, saving, and investment.

Strengthening financial infrastructure: Investments in financial infrastructure, such as the establishment of bank branches and the deployment of mobile banking infrastructure, can improve access to financial services in underserved areas.

Simplifying account opening processes: Governments can introduce simplified and digital account opening processes that reduce the documentation requirements while ensuring proper risk management and compliance.

Promoting gender equality: Efforts should be made to address the gender gap in financial inclusion. This can include providing targeted financial literacy programs for women, promoting women’s entrepreneurship, and addressing legal and cultural barriers that limit women’s access to financial services.

Encouraging collaboration and partnerships: Cooperation among financial institutions, governments, technology providers, and NGOs can harness their collective efforts and resources to drive financial inclusion effectively.

Best Practices for Implementing Financial Inclusion Initiatives

Implementing financial inclusion initiatives requires careful planning and execution.

Some best practices to consider include:

Conduct thorough research and needs assessments to identify the specific financial needs and barriers of the target population.

Developing tailored initiatives that address the unique challenges faced by different communities and target populations.

Leveraging technology to expand access to financial services, particularly mobile banking and digital payment solutions.

Building partnerships and collaborations among stakeholders to foster a collective approach to financial inclusion.

Monitoring and evaluating the impact of financial inclusion initiatives to measure effectiveness and identify areas for improvement.

The Role of Financial Institutions in Promoting Inclusion

Financial institutions play a vital role in promoting financial inclusion. They have the resources, expertise, and infrastructure to reach underserved populations and provide them with essential financial services.

Some key actions financial institutions can take to promote inclusion include:

Investing in technology:

Financial institutions should embrace technology and explore innovative solutions to reach unbanked and underbanked individuals. This can include developing mobile banking apps, expanding digital payment options, and integrating automated systems to streamline processes.

Tailoring products and services:

Financial institutions need to develop products and services that meet the diverse needs of different populations. This includes offering flexible repayment terms, affordable interest rates, and simplified account opening processes.

Expanding physical presence:

While digital solutions are important, financial institutions should also consider expanding their physical presence in underserved areas. Establishing brick-and-mortar branches or agency banking locations can improve accessibility, particularly for individuals who may not have access to technology.

Collaborating with stakeholders:

Financial institutions should work closely with governments, NGOs, and technology providers to create partnerships that drive financial inclusion. By leveraging each other’s strengths and resources, these collaborations can lead to more comprehensive and impactful initiatives.

Measuring the Impact of Financial Inclusion Initiatives

Measuring the impact of financial inclusion initiatives is crucial to assess their effectiveness and identify areas for improvement.

Some key indicators for measuring impact include:

Financial access: The percentage of individuals or households that have access to a bank account or other formal financial services.

Usage of financial services: The frequency and extent to which individuals utilize financial services, such as making deposits, withdrawals, and loan uptake.

Financial literacy: The level of understanding and knowledge individuals have about financial concepts and services.

Economic empowerment: The extent to which financial inclusion initiatives have enabled individuals to generate income, start businesses, and improve their overall economic well-being.

Poverty reduction: The impact of financial inclusion initiatives on reducing poverty levels within a targeted community or population.

By tracking these indicators and conducting regular impact assessments, policymakers, financial institutions, and other stakeholders can make informed decisions and refine their strategies to achieve sustainable financial inclusion.

Financial Inclusion Initiatives Around the World

Financial inclusion initiatives are being implemented across the globe, as countries recognize the importance of promoting universal access to financial services.

Some notable examples of financial inclusion initiatives include:

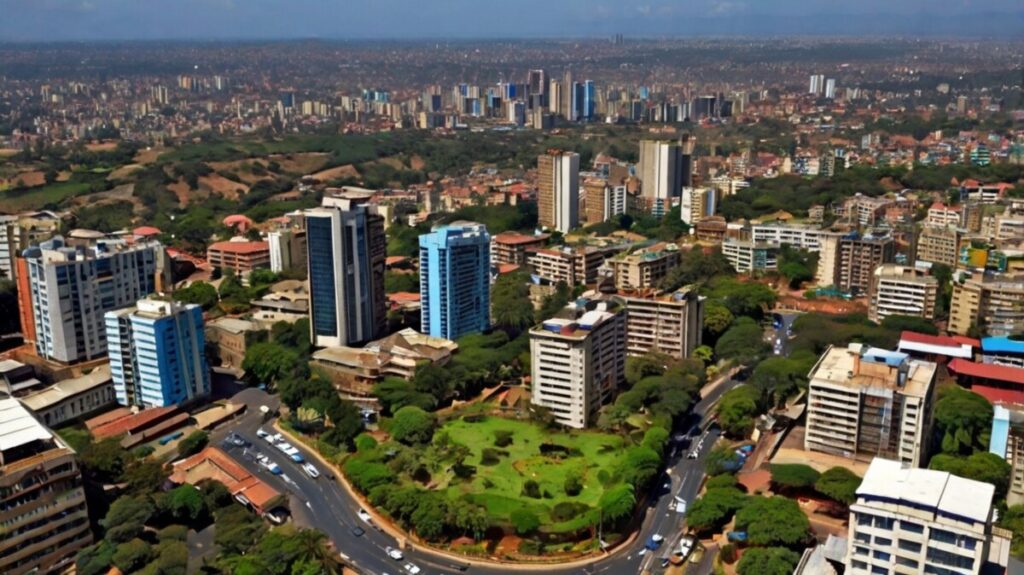

Kenya’s M-PESA:

M-PESA is a mobile banking platform that has transformed Kenya’s financial landscape, providing millions of individuals with access to basic banking services through their mobile phones. M-PESA allows users to deposit, withdraw, and transfer funds easily, providing convenience and security to millions of Kenyans.

India’s Pradhan Mantri Jan Dhan Yojana:

India launched the Pradhan Mantri Jan Dhan Yojana (PMJDY) in 2014 to provide every household with access to a basic bank account and other financial services. This initiative has been highly successful, with millions of previously unbanked individuals gaining access to financial services.

Brazil’s Bolsa Família:

Bolsa Família is a conditional cash transfer program in Brazil that aims to alleviate poverty and promote financial inclusion. The program provides financial assistance to low-income families, enabling them to meet their basic needs and improve their overall well-being.

These examples demonstrate the transformative power of financial inclusion initiatives, as they have brought millions of individuals into the formal financial system, providing them with the tools and opportunities to improve their lives.

Tools and Resources for Financial Inclusion

Various tools and resources are available to support financial inclusion initiatives.

These include:

Financial inclusion toolkits: Organizations such as the Alliance for Financial Inclusion and the World Bank provide toolkits that offer guidance and best practices for implementing financial inclusion initiatives.

Technology platforms: FinTech companies and technology providers offer innovative solutions, such as mobile banking platforms and digital wallets, that enhance financial inclusion efforts.

Financial literacy programs: Many organizations develop and offer financial literacy programs and educational resources to empower individuals with the knowledge and skills needed to make informed financial decisions.

Research and data: International financial institutions, such as the World Bank and the International Monetary Fund, produce research and data on financial inclusion that can inform policymakers and stakeholders.

By leveraging these tools and resources, stakeholders involved in financial inclusion initiatives can enhance their effectiveness and drive sustainable change.

Conclusion

Financial inclusion initiatives play a vital role in bridging the gap between individuals and communities that have been excluded from the formal financial system. These initiatives foster economic growth, reduce poverty, and promote social empowerment. By leveraging technology, collaborating with stakeholders, and adopting best practices, financial inclusion initiatives have the potential to transform lives and communities worldwide. Continued efforts and investments in financial inclusion are essential to creating a more inclusive and equitable global economy.

https://fiscalfitnessflow.com/index.php/2024/04/25/tax-smart-investing-strategies-for-maximizing-returns/

https://www.cgap.org/

FAQs

Q: What are financial inclusion initiatives?

A: Financial inclusion initiatives aim to provide access to essential financial products and services to all individuals, especially targeting the unbanked population. These initiatives promote inclusive financial systems that allow everyone to participate in the financial sector.

Q: How do financial service providers contribute to financial inclusion?

A: Financial service providers play a crucial role in promoting financial inclusion by offering tailored financial products that meet the needs of underserved communities. They help facilitate access to digital financial services, encouraging broader use of financial services among the unbanked.

Q: What is the significance of digital financial inclusion?

A: Digital financial inclusion is vital as it leverages technology to provide financial services to those who are traditionally excluded from the banking system. It enhances financial capability by making financial services more accessible and affordable through digital platforms.

Q: What strategies can be implemented to achieve financial inclusion?

A: Effective financial inclusion strategies include improving financial education, enhancing access to digital financial services, and fostering partnerships between government and financial institutions to create an inclusive financial ecosystem.

Q: How does financial education impact financial inclusion?

A: Financial education empowers individuals with the knowledge and skills necessary to make informed financial decisions, utilize financial products effectively, and improve their overall financial health. This, in turn, promotes greater participation in the financial system.